Already listed on the IDX? Your Business is Eligible for an Income Tax (PPh) Reduction of 3%

June 2023

The provisions of the Income Tax Law (UU PPh) in Indonesia, companies listed on the Indonesia Stock Exchange (BEI) are eligible for a lower tax rate.

According to Law No. 7 of 2021 on the Harmonization of Tax Regulations, domestic corporate taxpayers who are registered, have all of their shares fully paid up, trade at least 40% (forty percent) of their shares on the Indonesian stock exchange, and meet other requirements are entitled to a 3% (three percent) lower corporate income tax rate.

The Increasing Number of Listed Companies on the IDX

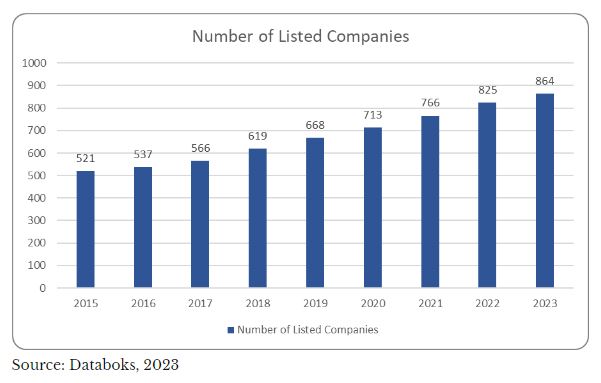

The number of businesses going public is increasing, according to a statement released by the IDX. Databoks (2023) charted the growth in the number of corporate taxpayers listed on the stock exchange for the years 2015–2023. The following graph illustrates this growth:

Table 1.1

From this Table 1.1, it can be seen that from 2015 to 2023 the number of corporate taxpayers registered on the IDX increased from 521 to 864. Although matters concerning intensive reductions in tax rates have been regulated since 2008, through Law Number 36 of 2008.

Derivative Regulations

In order to harmonize its tax regulations, the government issued Minister of Finance Regulation Number 40 of 2023 concerning Forms and Procedures for Submission of Reports and Taxpayer Lists, to meet the requirements needed by public companies as taxpayers.

A follow-up to Article 17 paragraph (2b) of the Law on the Harmonization of Tax Regulations reduces the income tax rate for domestic public companies on the IDX.

PMK No. 40 of 2023 stipulates that domestic corporate taxpayers can obtain a rate reduction of 3% if they meet the following requirements:

- They are public companies that list their shares on the IDX.

- The number of taxpayer shares paid up and traded on the stock exchange in Indonesia is at least 40% (forty percent).

- Their shares are owned by at least 300 shareholders

- Their shares are owned by the parties for a minimum of 183 days.

- The companies report their shareholders to the DGT.

Minister of Finance Regulation Number 40 of 2023 also provides an exception that excludes taxpayers who have a special relationship with their shareholders from the definition of taxpayers who can obtain a reduced corporate income tax rate.

Procedure for reporting DGT that is eligible for a tax rate reduction.

One of the requirements for corporate taxpayers to obtain a reduced corporate income tax rate is to submit a report to the DGT. There are two forms of reports to be submitted to DGT, as follows;

- Monthly report

- Shareholding report (which has an affiliated relationship)

Minister of Finance Regulation Number 40 of 2023, which went into effect on April 11, 2023, specifies the reporting format and process. A corporate income tax rate of 22% will be applied to reports that don't comply with the Regulation’s standards (22% of the total).

Please get in touch with us for additional details on our services including tax advisory: contact-Jakarta@moores-rowland.com or contact-Bali@moores-rowland.com.

**By: Stefani W. Anggraeni — Marketing Communications Manager & Social Media Specialist