Check Out The New PPh Article 21 Regulations and The Simple Calculation Method effective 2024

February 2024

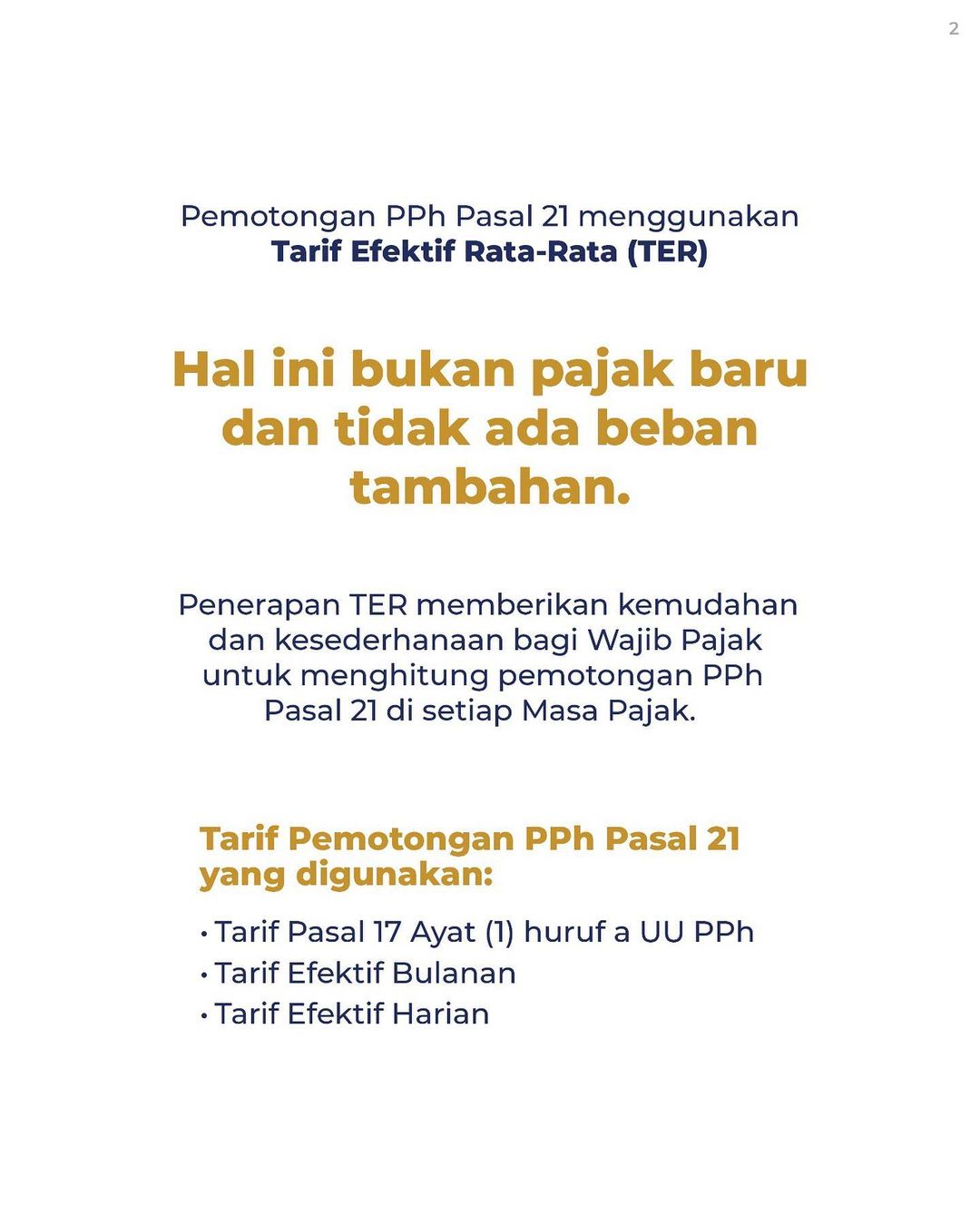

The Indonesian government is taking important steps to make adjustments to the withholding rates in Income Tax Article 21 (PPh 21) in 2024. As per Government Regulation (PP) Number 58 of 2023, the withholding rates on income from work, services, or activities received by taxpayers using the new rate, namely the effective average rate, or Tarif Efektif Rata-rata (TER), will came into effect on January 1, 2024.

The new TER PPh 21 contained in PP 58/2023 takes into account several deductions from gross income, such as office fees or pension costs, pension contributions, and non-taxable income (PTKP).

This update to the regulations regarding PPh 21 withholding rates aims to provide convenience and simplicity in the technical calculation and administration of PPh Article 21 withholding for taxpayers, including state officials, civil servants (PNS), members of the national military and police (TNI/Polri), and retirees.

Types of TER for PPh 21 Updated in 2023

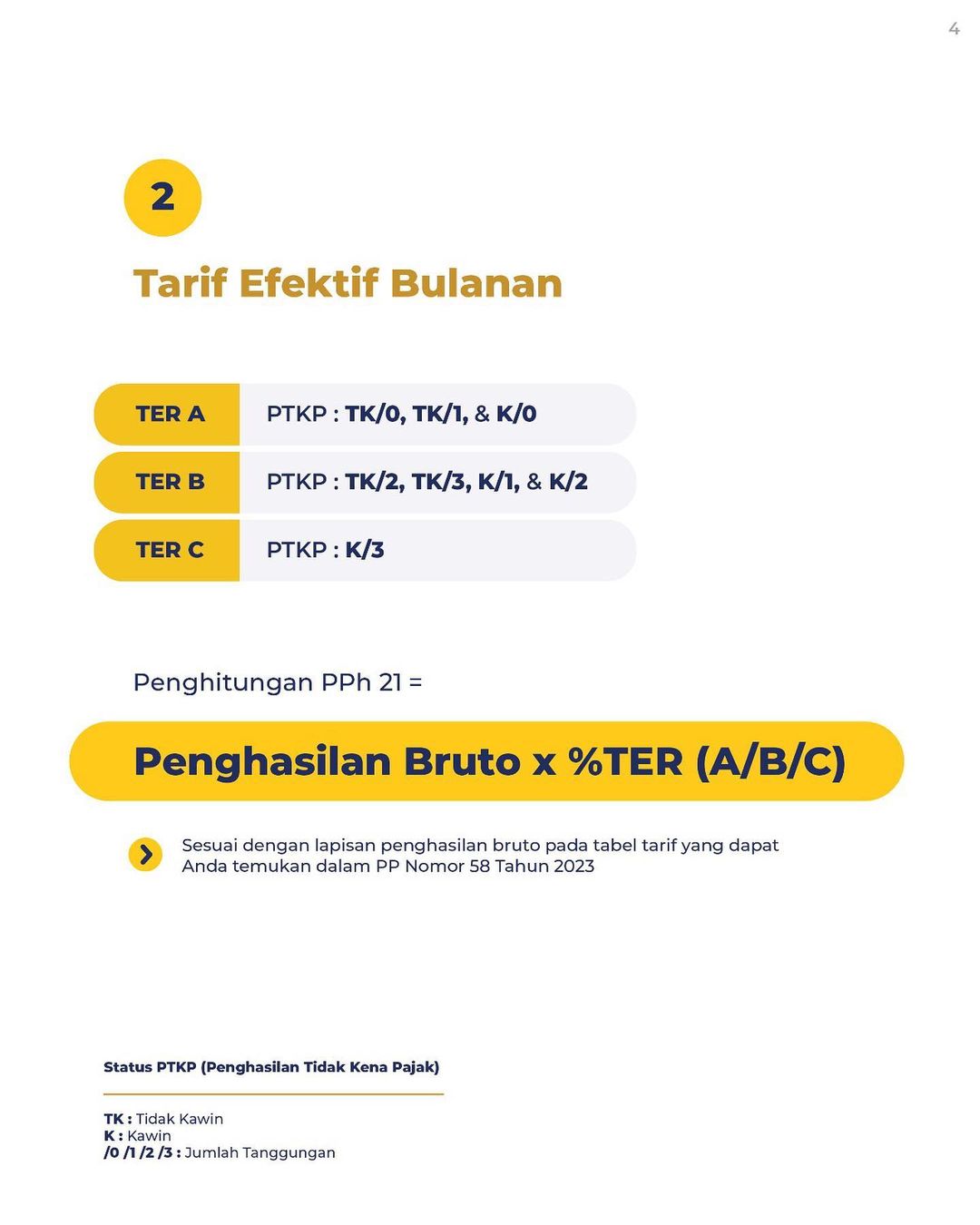

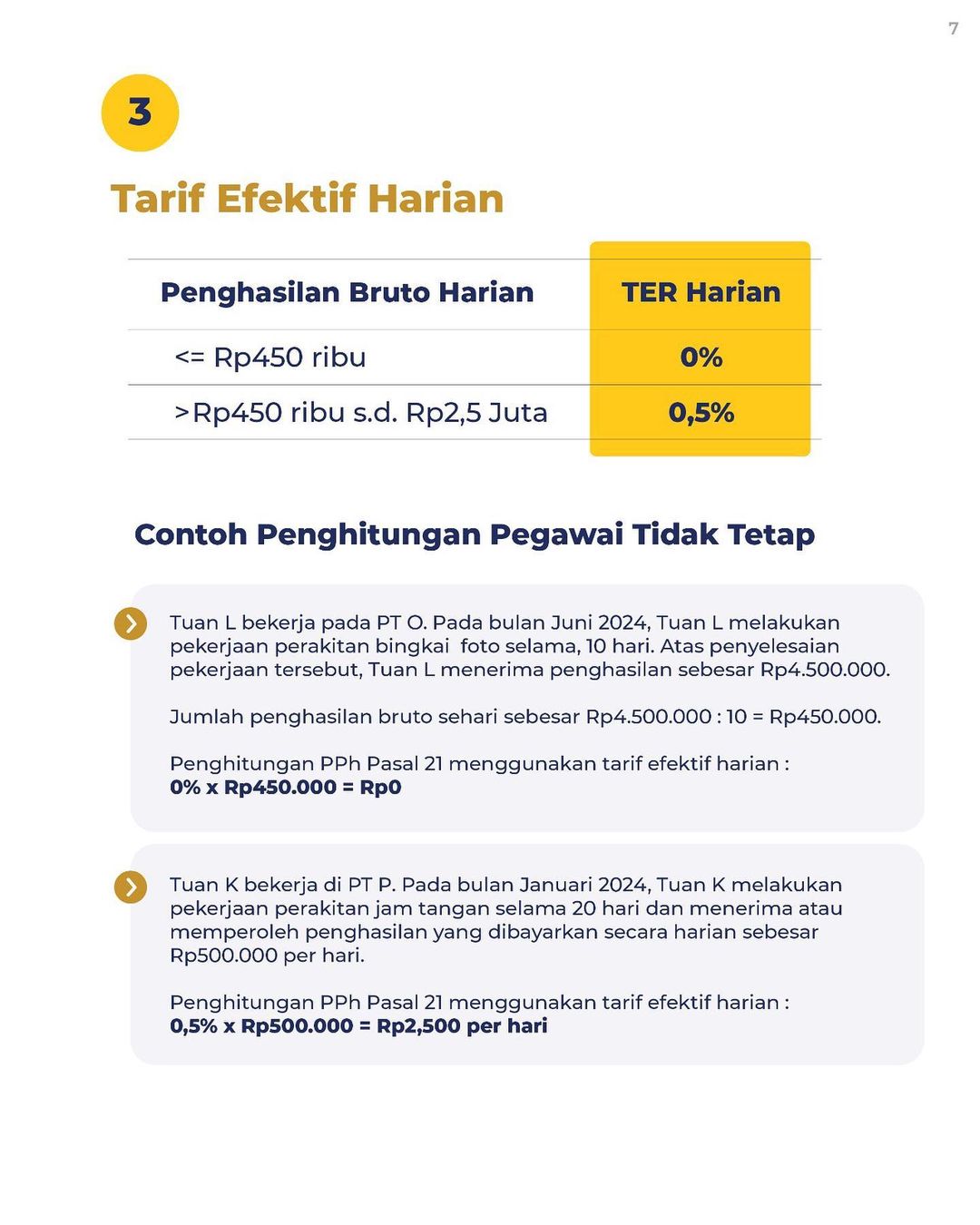

Based on Article 2 PP 58/2023, the TER for PPh 21 is divided into two types: the monthly TER and daily TER. The monthly TER is imposed on gross income received monthly in one tax period by individual taxpayers with permanent employee status. The daily TER is imposed on gross income received daily, weekly, individually, or in bulk by individual taxpayers with non-permanent employee status.

Monthly TER of PPh 21

The monthly PPh 21 withholding rate consists of the monthly TER and the Article 17 paragraph (1) income tax rate. This monthly TER is used to calculate PPh 21 for each tax period, apart from the last tax period. For the end of tax period (December), the calculation of PPh 21 continues to use the rates of Article 17 paragraph (1) letter a of the Income Tax Law as the current provisions. The monthly TER for PPh 21 is divided into three categories, A, B, and C. This monthly TER category is based on non-taxable income (PTKP) according to marital status and the number of dependents of the taxpayer at the beginning of the tax year.

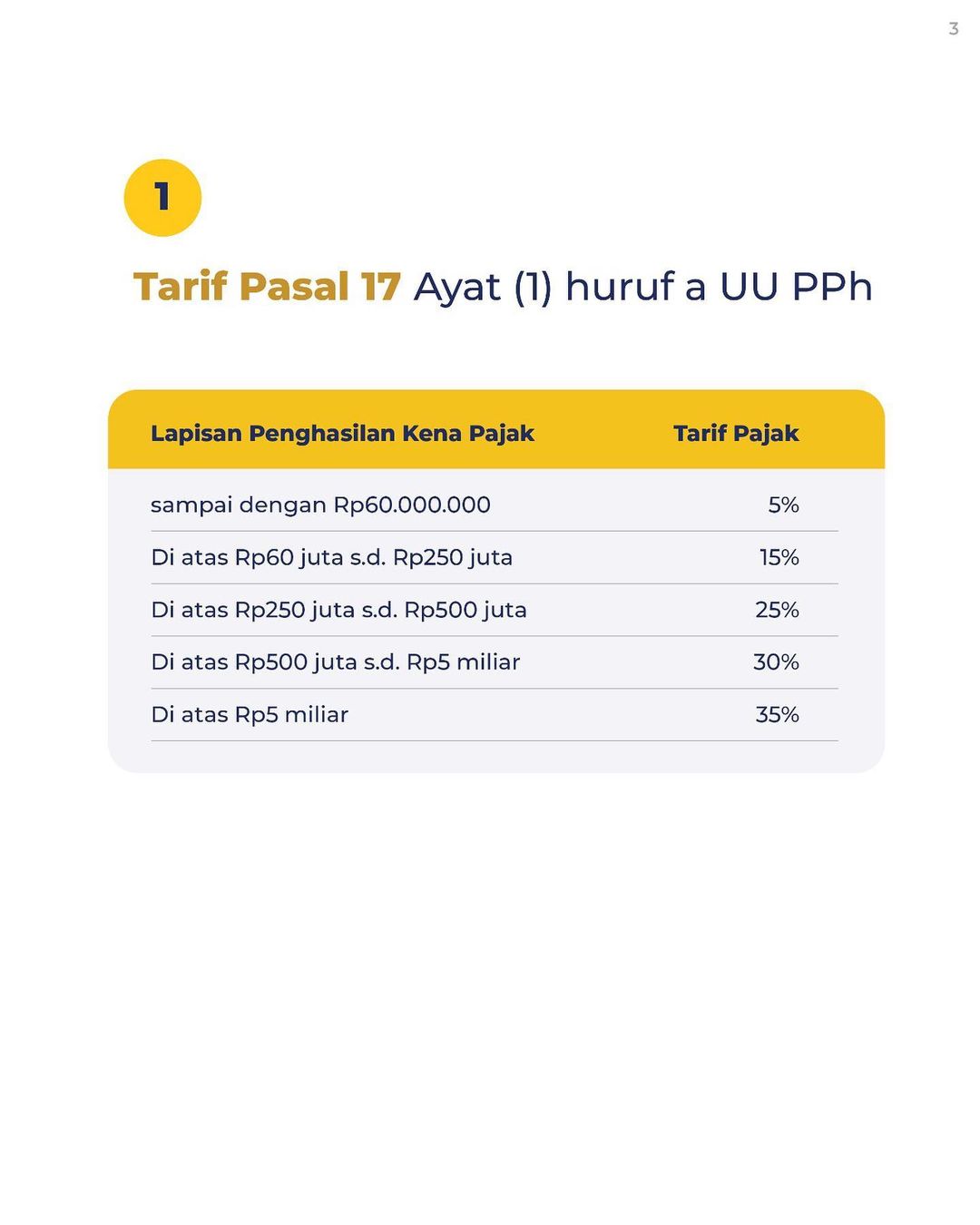

In simple terms, the income tax rate has five levels, ranging from 5 percent to 35 percent, as per the following:

- For income up to IDR 60 million the tax rate is 5 percent.

- IDR 60 million to IDR 250 million the tax rate is 15 percent.

- IDR 250 million to IDR 500 million the tax rate is 25 percent.

- IDR 500 million to IDR 5 billion the tax rate is 30 percent.

- Above IDR 5 billion the tax rate is 35 percent.

A. Monthly TER Category A (TER A)

The monthly TER category A is applied to the monthly gross income of individuals with PTKP status:

- Not married without dependents (TK/0)

- Not married with 1 dependent (TK/1)

- Married without dependents (K/0)

The monthly TER for category A has a PPh 21 rate starting from 0% for gross monthly income up to IDR 5.4 million, to 34% for gross monthly income above IDR 1.4 billion.

Details of all monthly TER category A based on each layer of monthly gross income can be seen in the following table:

|

Monthly TER A -> (TK/0);(TK/1);(K/0) |

||

|

NO |

Monthly Gross Income Layer |

Tax Rates |

|

1 |

IDR 0 – IDR 5,4 Mio |

0% |

|

2 |

> IDR 5,4 Mio – IDR 5,65 Mio |

0,25% |

|

3 |

> IDR 5,65 Mio – IDR 5,95 Mio |

0,5% |

|

4 |

> IDR 5,95 Mio – IDR 6,3 Mio |

0,75% |

|

5 |

> IDR 6,3 Mio – IDR 6,75 Mio |

1% |

|

6 |

> IDR 6,75 Mio – IDR 7,5 Mio |

1,25% |

|

7 |

> IDR 7,5 Mio – IDR 8,55 Mio |

1,5% |

|

8 |

> IDR 8,55 Mio – IDR 9,65 Mio |

1,75% |

|

9 |

> IDR 9,65 Mio – IDR 10,05 Mio |

2% |

|

10 |

> IDR 10,05 Mio – IDR 10,35 Mio |

2,25% |

|

11 |

> IDR 10,35 Mio – IDR 10,7 Mio |

2,5% |

|

12 |

> IDR 10,7 Mio – IDR 11,05 Mio |

3% |

|

13 |

> IDR 11,05 Mio – IDR 11,6 Mio |

3,5% |

|

14 |

> IDR 11,6 Mio – IDR 12,5 Mio |

4% |

|

15 |

> IDR 12,5 Mio – IDR 13,75 Mio |

5% |

|

16 |

> IDR 13,75 Mio – IDR 15,1 Mio |

6% |

|

17 |

> IDR 15,1 Mio – IDR 16,95 Mio |

7% |

|

18 |

> IDR 16,95 Mio – IDR 19,75 Mio |

8% |

|

19 |

> IDR 19,75 Mio – IDR 24,15 Mio |

9% |

|

20 |

> IDR 24,15 Mio – IDR 26,45 Mio |

10% |

|

21 |

> IDR 26,45 Mio – IDR 28 Mio |

11% |

|

22 |

> IDR 28 Mio – IDR 30,05 Mio |

12% |

|

23 |

> IDR 30,05 Mio – IDR 32,4 Mio |

13% |

|

24 |

> IDR 32,4 Mio – IDR 35,4 Mio |

14% |

|

25 |

> IDR 35,4 Mio – IDR 39,1 Mio |

15% |

|

26 |

> IDR 39,1 Mio – IDR 43,85 Mio |

16% |

|

27 |

> IDR 43,85 Mio – IDR 47,8 Mio |

17% |

|

28 |

> IDR 47,8 Mio – IDR 51,4 Mio |

18% |

|

29 |

> IDR 51,4 Mio – IDR 56,3 Mio |

19% |

|

30 |

> IDR 56,3 Mio – IDR 62,2 Mio |

20% |

|

31 |

> IDR 62,2 Mio – IDR 68,6 Mio |

21% |

|

32 |

> IDR 68,6 Mio – IDR 77,5 Mio |

22% |

|

33 |

> IDR 77,5 Mio – IDR 89 Mio |

23% |

|

34 |

> IDR 89 Mio – IDR 103 Mio |

24% |

|

35 |

> IDR 103 Mio – IDR 125 Mio |

25% |

|

36 |

> IDR 125 Mio – IDR 157 Mio |

26% |

|

37 |

> IDR 157 Mio – IDR 206 Mio |

27% |

|

38 |

> IDR 206 Mio – IDR 337 Mio |

28% |

|

39 |

> IDR 337 Mio – IDR 454 Mio |

29% |

|

40 |

> IDR 454 Mio – IDR 550 Mio |

30% |

|

41 |

> IDR 550 Mio – IDR 695 Mio |

31% |

|

42 |

> IDR 695 Mio – IDR 910 Mio |

32% |

|

43 |

> IDR 910 Mio – IDR 1,4 Billion |

33% |

|

44 |

> IDR 1,4 Billion and above |

34% |

Source: www.pajakku.com

Example:

'Mr. X' is an individual taxpayer who is married and no dependents. He works as a permanent employee at 'PT Jaya Abadi' and receives a salary of IDR 10,000,000.00 per month.

Based on non-taxable income (PTKP) status and total gross income, the employer calculates PPh Article 21 for 'Mr. X' using the monthly TER Category A rate of 2.25%. Thus, the amount of PPh Article 21 on 'Mr. X's income is:

January - November: IDR 10,000,000.00 x 2.25% = IDR 225,000.00/month

December: IDR 2,775,000 minus (IDR 225,000.00 x 11) = IDR 300,000.00

B. Monthly TER Category B (TER B)

Monthly TER category B rate is applied to the monthly gross income of individuals with PTKP status:

Not married with :

- 2 dependents (TK/2) up to

- 3 dependents (TK/3)

Married with :

- 1 dependent (K/1)

- 2 dependents (K/2)

Monthly TER category B starts from 0% for gross monthly income of up to IDR 6.2 million, to 34% for gross monthly income of above IDR 1.405 billion.

Details of all Monthly TER category B based on each layer of monthly gross income can be seen in the following table:

|

Monthly TER B -> (TK/2);(TK/3);(K/1);(K/2) |

||

|

NO |

Monthly Gross Income Layer |

Tax Rates |

|

1 |

IDR 0 – IDR 6,2 Mio |

0% |

|

2 |

> IDR 6,2 Mio – IDR 6,5 Mio |

0,25% |

|

3 |

> IDR 6,5 Mio – IDR 6,85 Mio |

0,5% |

|

4 |

> IDR 6,85 Mio – IDR 7,3 Mio |

0,75% |

|

5 |

> IDR 7,3 Mio – IDR 9,2 Mio |

1% |

|

6 |

> IDR 9,2 Mio – IDR 10,75 Mio |

1,5% |

|

7 |

> IDR 10,75 Mio – IDR 11,25 Mio |

2% |

|

8 |

> IDR 11,25 Mio – IDR 11,6 Mio |

2,5% |

|

9 |

> IDR 11,6 Mio – IDR 12,6 Mio |

3% |

|

10 |

> IDR 12,6 Mio – IDR 13,6 Mio |

4% |

|

11 |

> IDR 13,6 Mio – IDR 14,95 Mio |

5% |

|

12 |

> IDR Rp14,95 Mio – IDR 16,4 Mio |

6% |

|

13 |

> IDR Rp16,4 Mio – IDR 18,45 Mio |

7% |

|

14 |

> IDR 18,45 Mio – IDR 21,85 Mio |

8% |

|

15 |

> IDR 21,85 Mio – IDR 26 Mio |

9% |

|

16 |

> IDR 26 Mio – IDR 27,7 Mio |

10% |

|

17 |

> IDR 27,7 Mio – IDR 29,35 Mio |

11% |

|

18 |

> IDR 29,35 Mio – IDR 31,45 Mio |

12% |

|

19 |

> IDR 31,45 Mio – IDR 33,95 Mio |

13% |

|

20 |

> IDR 33,95 Mio – IDR 37,1 Mio |

14% |

|

21 |

> IDR 37,1 Mio – IDR 41,1 Mio |

15% |

|

22 |

> IDR 41,1 Mio – IDR 45,8 Mio |

16% |

|

23 |

> IDR 45,8 Mio – IDR 49,5 Mio |

17% |

|

24 |

> IDR 49,5 Mio – IDR 53,8 Mio |

18% |

|

25 |

> IDR 53,8 Mio – IDR 58,5 Mio |

19% |

|

26 |

> IDR 58,5 Mio – IDR 64 Mio |

20% |

|

27 |

> IDR 64 Mio – IDR 71 Mio |

21% |

|

28 |

> IDR 71 Mio – IDR 80 Mio |

22% |

|

29 |

> IDR 80 Mio – IDR 93 Mio |

23% |

|

30 |

> IDR 93 Mio – IDR 109 Mio |

24% |

|

31 |

> IDR 109 Mio – IDR 129 Mio |

25% |

|

32 |

> IDR 129 Mio – IDR 163 Mio |

26% |

|

33 |

> IDR 163 Mio – IDR 211 Mio |

27% |

|

34 |

> IDR 211 Mio – IDR 374 Mio |

28% |

|

35 |

> IDR 374 Mio – IDR 459 Mio |

29% |

|

36 |

> IDR 459 Mio – IDR 555 Mio |

30% |

|

37 |

> IDR 555 Mio – IDR 704 Mio |

31% |

|

38 |

> IDR 704 Mio – IDR 957 Mio |

32% |

|

39 |

> IDR 957 Mio – IDR 1,405 Billion |

33% |

|

40 |

> IDR 1,405 Billion |

34% |

Source: www.pajakku.com

C. Monthly TERCategory C (TER C)

Category C monthly TER is applied to the gross income of individuals with married PTKP status and with three dependents (K/3).

Category C monthly TER has a PPh 21 rate starting from 0% for gross monthly income of up to IDR 6.6 million, to 34% for gross monthly income of above IDR 1.419 billion.

Details of all the monthly TER for category C based on each layer of monthly gross income can be seen in the following table:

|

MonthlyTER C -> (K/3) |

||

|

NO |

Monthly Gross Income Layer |

Tax Rates |

|

1 |

IDR 0 – IDR 6,6 juta |

0% |

|

2 |

> IDR 6,6 Mio – IDR 6,95 Mio |

0,25% |

|

3 |

> IDR 6,95 Mio – IDR 7,35 Mio |

0,5% |

|

4 |

> IDR 7,35 Mio – IDR 7,8 Mio |

0,75% |

|

5 |

> IDR 7,8 Mio – IDR 8,85 Mio |

1% |

|

6 |

> IDR 8,85 Mio – IDR 9,8 Mio |

1,25% |

|

7 |

> IDR 9,8 Mio – IDR 10,95 Mio |

2% |

|

8 |

> IDR 10,95 Mio – IDR 11,2 Mio |

1,75% |

|

9 |

> IDR 11,2 Mio – IDR 12,05 Mio |

2% |

|

10 |

> IDR 12,05 Mio – IDR 12,95 Mio |

3% |

|

11 |

> IDR 12,95 Mio – IDR 14,15 Mio |

4% |

|

12 |

> IDR 14,15 Mio – IDR 15,55 Mio |

5% |

|

13 |

> IDR 15,55 Mio – IDR 17,05 Mio |

6% |

|

14 |

> IDR 17,05 Mio – IDR 19,5 Mio |

7% |

|

15 |

> IDR 19,5 Mio – IDR 22,7 Mio |

8% |

|

16 |

> IDR 22,7 Mio – IDR 26,6 Mio |

9% |

|

17 |

> IDR 26,6 Mio – IDR 28,1 Mio |

10% |

|

18 |

> IDR 28,1 Mio – IDR 30,1 Mio |

11% |

|

19 |

> IDR 30,1 Mio – IDR 32,6 Mio |

12% |

|

20 |

> IDR 32,6 Mio – IDR 35,4 Mio |

13% |

|

21 |

> IDR 35,4 Mio – IDR 38,9 Mio |

14% |

|

22 |

> IDR 38,9 Mio – IDR 43 Mio |

15% |

|

23 |

> IDR 43 Mio – IDR 47,4 Mio |

16% |

|

24 |

> IDR 47,4 Mio – IDR 51,2 Mio |

17% |

|

25 |

> IDR 51,2 Mio – IDR 55,8 Mio |

18% |

|

26 |

> IDR 55,8 Mio – IDR 60,4 Mio |

19% |

|

27 |

> IDR 60,4 Mio – IDR 66,7 Mio |

20% |

|

28 |

> IDR 66,7 Mio – IDR 74,5 Mio |

21% |

|

29 |

> IDR 74,5 Mio – IDR 83,2 Mio |

22% |

|

30 |

> IDR 83,2 Mio – IDR 95,6 Mio |

23% |

|

31 |

> IDR 95,6 Mio – IDR 110 Mio |

24% |

|

32 |

> IDR 110 Mio – IDR 134 Mio |

25% |

|

33 |

> IDR 134 Mio – IDR 169 Mio |

26% |

|

34 |

> IDR 169 Mio – IDR 221 Mio |

27% |

|

35 |

> IDR 221 Mio – IDR 390 Mio |

28% |

|

36 |

> IDR 390 Mio – IDR 463 Mio |

29% |

|

37 |

> IDR 463 Mio – IDR 561 Mio |

30% |

|

38 |

> IDR 561 Mio – IDR 709 Mio |

31% |

|

39 |

> IDR 709 Mio – IDR 965 Mio |

32% |

|

40 |

> IDR 965 Mio – IDR 1,419 Billion |

33% |

|

41 |

> IDR 1,419 Billion |

34% |

TER, and The Simple Calculation Method in 2024

The PP Number 58 Year 2023 is applicable beginning January 1, 2024. The goal of this rule is to make it easier to calculate tax income under Article 21 using the effective average rate (TER). This regulation does not impose any new taxes; hence, there is no additional tax burden.

To understand TER under this new regulation, please check out the key points in this infographic:

Source: @ditjenpajakri

For more details on our auditing, accounting, outsourcing, payroll, legal, taxation, auditing, and advisory services, email: contact-jakarta@moores-rowland.com or contact-bali@moores-rowland.com.

**By: Stefani W. Anggraeni — Marketing Communications Manager & Social Media Specialist